When most people move into a new home, they sell their old property. But this isn’t your only option! If you want to skip the stress of marketing your home and negotiating with buyers—especially during the age of social distancing—consider turning it into a rental property. Converting your residence into a rental is a great way to get into the world of real estate investing and earn some passive income. Here are some tips and tricks to help you get set up and find your first tenants!

Make a Few Upgrades

Of course, before you can rent your home out to tenants, you will have to repair anything that needs fixing. One of your responsibilities is to provide a well-maintained property. After this, consider making some upgrades! For example, give the walls a fresh coat of paint, replace your plumbing fixtures, and if you have hardwood floors, get them refinished and polished. Think about lighting that gives the home a welcoming vibe. You might even want to make some home efficiency upgrades to reduce your utility bills. At the very least, Mashvisor explains that adding in-demand features to your property should let you charge higher rental rates!

If you’re going to be doing any major renovations, make sure you come up with the funding first. Cash-out refinancing could be a viable option, especially right now—the coronavirus pandemic has resulted in low mortgage rates! As PMUSA explains, cash-out refinancing involves replacing your existing mortgage loan with a loan of a higher amount and receiving the difference in cash. It’s common for homeowners to use this cash to make home upgrades, and with such tantalizing rates, you might want to strike while the iron is hot.

Protect Your Finances

Renting out property is always somewhat risky, even if you already own the home. Planning ahead will ensure your cash flow is secure. This is especially important given the financial uncertainty surrounding the virus! Start by estimating your monthly expenses and comparing these to your desired rental rate, remembering to account for hidden costs like emergency maintenance, insurance premiums, and vacancies. To get an idea of what you can charge for rent, look at the average rates for other rentals in your area, specifically for properties that are similar to yours.

It’s also important to update your insurance when you become a landlord. Allstate explains that your existing homeowner’s insurance won’t cover accidents, robberies, or disasters that occur in your rental, so be sure to protect yourself with landlord insurance!

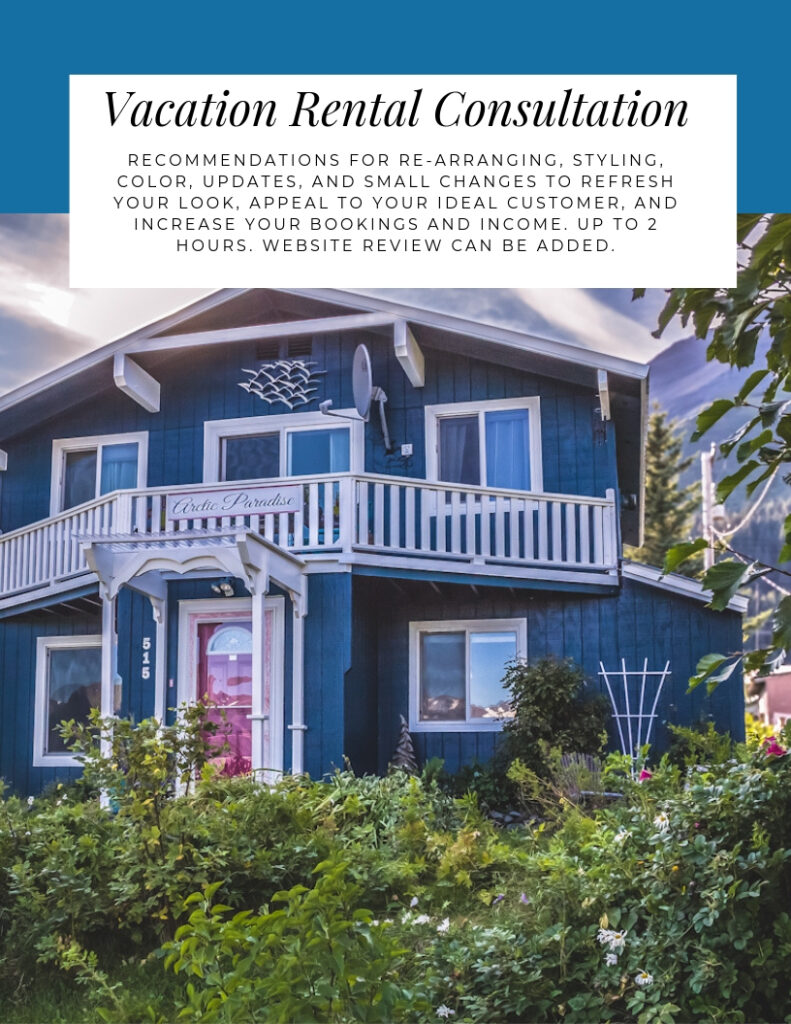

Consider Long Term versus Short Term Rentals

Consider whether you want to do a short-term rentals such as vacation rentals, or a long term rentals for housing. Short term rentals require more work and time on your part but may give you a higher return per night and more flexibility to list your home for sale when the time is right. Short term rentals will like need to be designed and furnished to attract your ideal renters. Long term rentals may be more appealing to renters but offer you less flexibility when you want to sell.

Start Looking for Tenants

When you’re finally ready to look for tenants, start with a good rental listing. Write a catchy headline, include several quality photos, and list any information potential renters might want from you regarding the rental rate, security deposit, amenities, parking situation, move-in date, pet policy, and utilities.

Before signing a lease, make sure you screen your potential tenants thoroughly. Dealing with bad tenants is expensive and incredibly stressful, so you want to take all possible precautions to avoid issues. Some important steps in the screening process include running a background check, verifying the tenant’s income, and calling their previous landlords.

Create a Management Plan

Many first-time landlords don’t realize just how much work it is to manage a rental property. You will have to create lease agreements, collect rent, perform regular maintenance, and deal with all of the financial aspects of renting out a home. On top of all this, you must be prepared to respond to tenant concerns and requests at any hour. If you have the budget for it, hiring a property manager will take a lot of these responsibilities off your plate. Your property manager can even help you set your rental rates and find tenants!

If you’re hesitant to put your home on the market during the coronavirus pandemic, consider renting it out instead! Renting out your home can be an exciting and rewarding endeavor, especially if you want to try real estate investing. Take the right steps to prepare your rental and you’re sure to enjoy success!

Written by guest blogger Suzie Wilson from Happier Home. Suzie is an Interior Designer and author.

Need Help Getting Your Rental Property to Stand Out from the Crowd Online?

Whether you are putting your home on the market, or renting it as a vacation or other rental, home staging and a color consultation can help you. Make sure your property stands out from the crowd and has great photos to attract your ideal renters, guests or your target buyers.

Call 907-362-0065 today

info@northernlightsstaging.com

Download my Brochure

Terms of Service | Privacy Policy | Disclaimer

Prices subject to change without notice. This post may contain affiliate links.

Pin These